Schedule of Availability of Service:

Monday – Friday; 8:00 AM – 12:00 NN; 1:00 – 5:00 PM

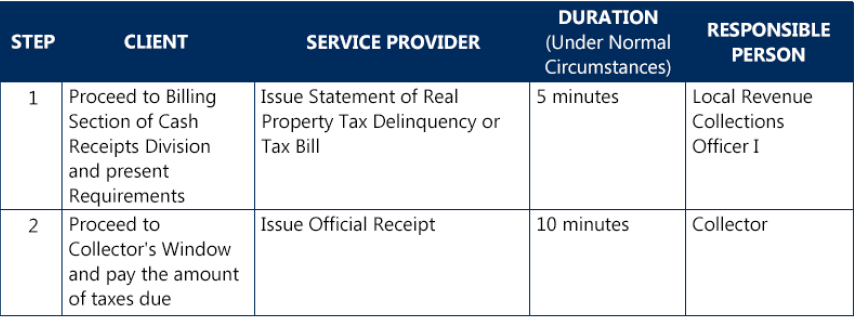

Who may avail of the Service:

Declared owners of real properties located within the territorial jurisdiction of the province

Requirement:

Latest Official Receipt

Tax Declaration

Request Slip, in the absence of the two requirements

Fees:

2% of Assessed value of real property + penalty in case of delinquency

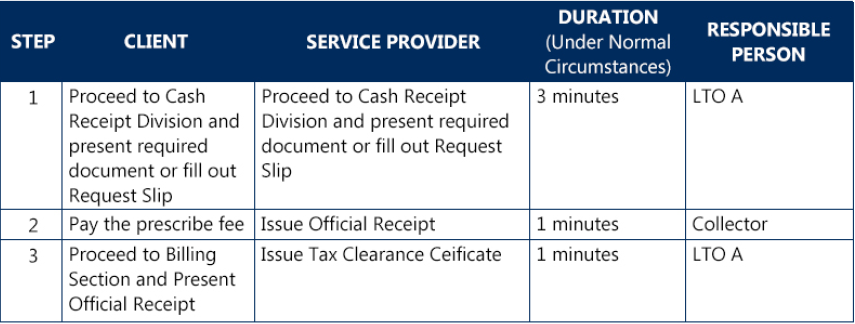

Schedule of Availability of Service:

Monday – Friday; 8:00 AM – 12:00 NN; 1:00 – 5:00 PM

Who may avail of the Service:

Real Property Owners

Requirement:

Official Receipt of taxes paid for the current year

Fees:

Official Receipt of taxes paid for the current year

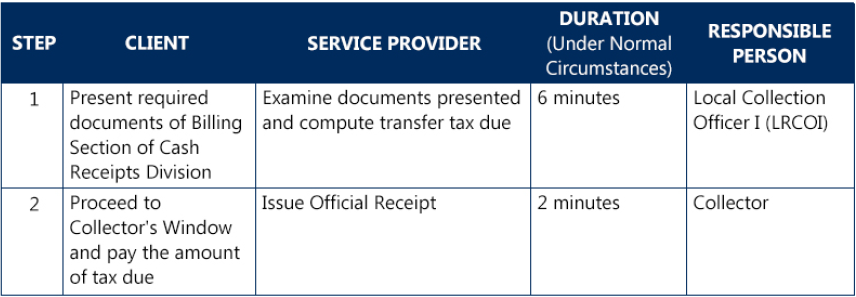

Schedule of Availability of Service:

Monday – Friday; 8:00 AM – 12:00 NN; 1:00 – 5:00 PM

Who may avail of the Service:

Real Property Owners

Requirement:

Real Property Tax Clearance

Tax Declaration

Pertinent papers to support the Transfer of ownership such as Deed of Donation, Deed of Sale, among others

Owner’s copy of Title of the Property

Fees:

55% of 1% of the value of sale of fair market value, whichever is higher

Schedule of Availability of Service:

Monday – Friday; 8:00 AM – 12:00 NN; 1:00 – 5:00 PM

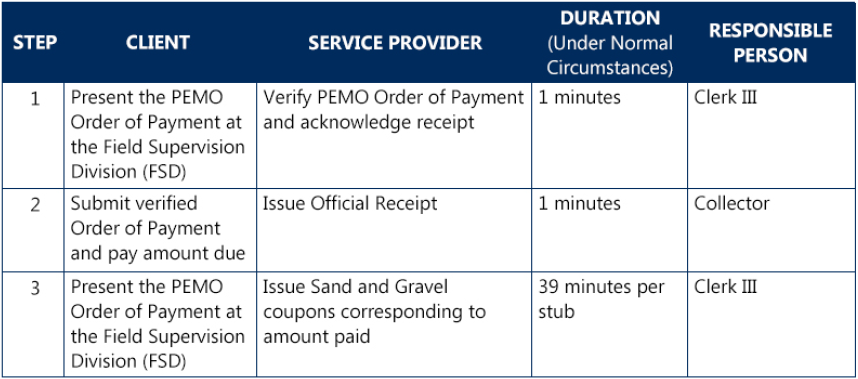

Who may avail of the Service:

Order of payment issued by the Provincial Environment Management Office

Schedule of Availability of Service:

Monday – Friday; 8:00 AM – 12:00 NN; 1:00 – 5:00 PM

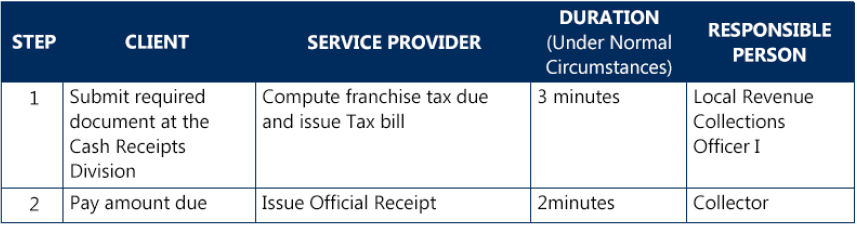

Who may avail of the Service:

Operators of business enjoying a franchise within territorial jurisdiction of the province

Requirement:

Sworn declaration of gross sales for the preceding year

Fees:

55% of 1% of gross receipt for the preceding year

Schedule of Availability of Service:

Monday – Friday; 8:00 AM – 12:00 NN; 1:00 – 5:00 PM

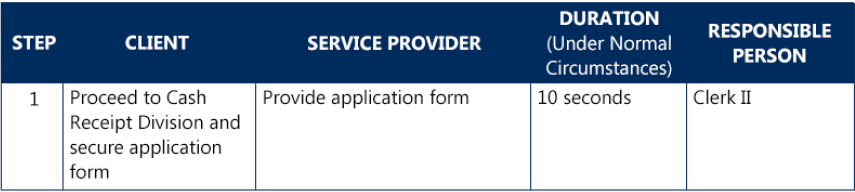

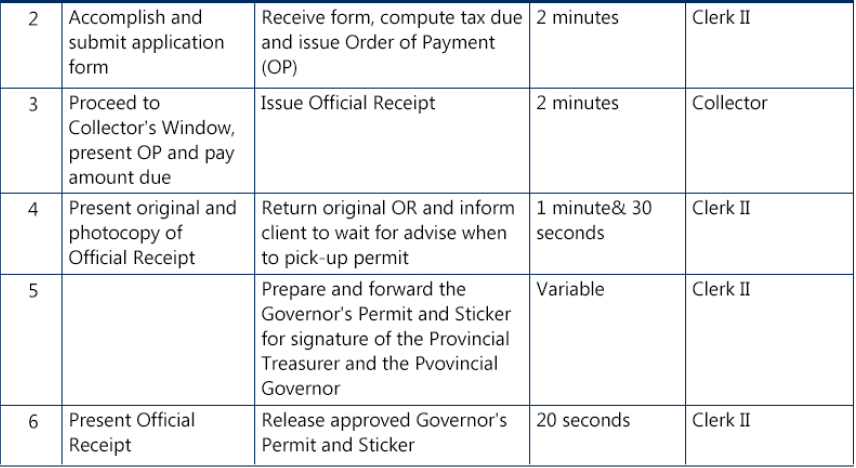

Who may avail of the Service:

Manufactures, dealers, wholesalers and retailers of products who own delivery trucks vans used to transport their goods for sale

Requirement:

Accomplished Application Form

Fees:

Please refer to Provincial Tax Ordinance No. 07-001

Schedule of Availability of Service:

Monday – Friday; 8:00 AM – 12:00 NN; 1:00 – 5:00 PM

Who may avail of the Service:

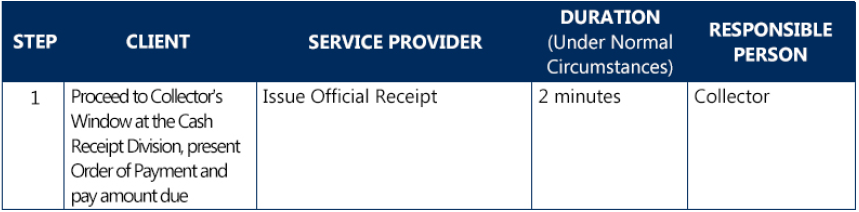

General Public availing government services or use government facilities

Requirement:

Order of Payment from issuing department or office in the Capitol

Schedule of Availability of Service:

Monday – Friday; 8:00 AM – 12:00 NN; 1:00 – 5:00 PM

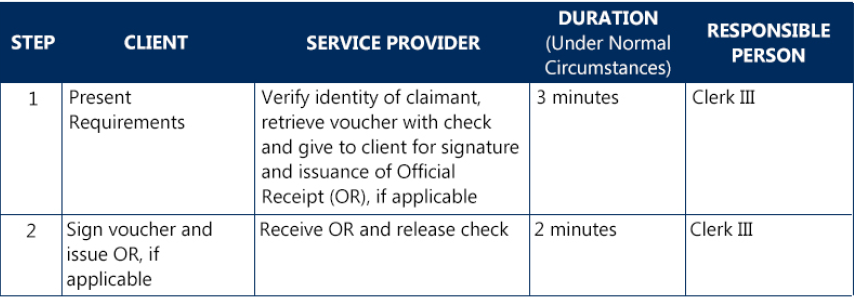

Who may avail of the Service:

Accredited suppliers having claims with the provincial government

Beneficiaries of financial assistance, scholarship grants and other social assistance

Employees having claims with the provincial government

Requirement:

Valid Identification (ID) card of claimants

Community Tax Certificate

Official Receipt – for claims of institutions